The majority of Australians are unprepared for retirement. Your retirement is the time when you will want to enjoy financial freedom and the lifestyle that can bring.

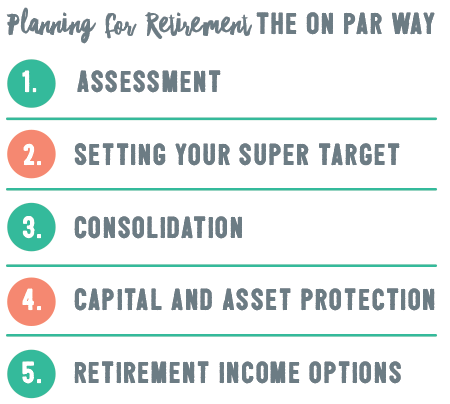

Super is a long term investment but shouldn’t be a set and forget strategy. At On Par, we will start with a thorough analysis of your existing super funds. We will conduct all the necessary research, consider your investment goals and formulate strategies to best meet your objectives

You may have one super fund or a number of funds. Due to people being time poor they may not manage these funds efficiently. This is where our expert help comes into play. We can decipher all the jargon and explain things clearly to you, which allows us to optimise your super and retirement.

As we do not receive commissions from super funds we are only here to provide you with the best outcome for you and your family. There is rarely a “best fund “so taking the time to discuss what retirement lifestyle you would like allows us to consider which fund will help you to achieve your dream outcome. The fund selection along with some good advice strategies can put you On Par for a comfortable retirement.

Retirement can be a daunting step! If you’re planning to retire soon or have already retired, then the protection of your capital and assets is generally one of things that keeps you up at night. Having a regular income to maintain your living standards and live as you planned is paramount to your retirement. At On Par we will guide you through this stage of life smoothly and efficiently. We will also work with you to maximise any government benefits you may be entitled to such as age pension or health benefits.